Anti-Avoidance a Go-Go…

VAT documents occupied a major portion of the previous week. Hence, the focus shifted toward anti-avoidance initiatives in this week’s plan. As anticipated, the point of focus is the OECD. Furthermore, the public highlights it for its stance on the Two Pillar solution. The reason is the acknowledgment of tax challenges because of the economic digitalization.

VAT documents occupied a major portion of the previous week. Hence, the focus shifted toward anti-avoidance initiatives in this week’s plan. As anticipated, the point of focus is the OECD. Furthermore, the public highlights it for its stance on the Two Pillar solution. The reason is the acknowledgment of tax challenges because of the economic digitalization.

The draft model rule for domestic legislation on scope under Amount A of pillar one awaits collective opinions. The newly announced consultation patiently waits until April 20. The scope rules aim to establish the group. Such that Amount A is only applicable to profitable organizations. The drafted rules require a quantitative application, according to OECD. The taxpayer remains within scope through this.

Later, HM Revenue and Customs, a UK tax agency, came up with a plan. It was the identification of the strategy behind tax avoidance and its promoters. Furthermore, the HMRC alerted the taxpayers. Individuals participating in equity schemes should withdraw instantly to avoid large tax bills.

Truth Behind Tax Escape Strategies

The HRMC’s Director of Counter Avoidance stated discussed details with the press. The schemers portray the idea as an easy way to escape tax or pay less. However, contrary to the marketer’s claim, things do not work similarly in real life. The targeted person usually finds themselves with a hefty tax bill.

Commonly, the strategy includes the payment of the National minimum wage to the contractor. They portray the remaining wage as a loan to steer clear of income tax.

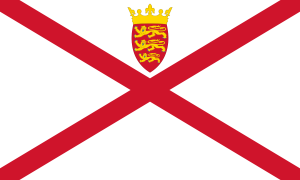

HMRC released the details of these schemes to make the taxpayers aware. The purpose is to give them a chance to steer clear or exit them. HMRC intends to update the list regularly. An announcement about the details of other tax avoidance schemes and their promoters takes place. The Government of Jersey has published the plan respective to the OECD’s initiative.

The OECD Policy Paper

The Government launched a policy paper, “OECD Pillars 1 & 2 — Tax Policy Reflections. It highlights the necessary changes to ensure the state stays an attractive hub for business.

The changes may significantly affect businesses. Implementing the two-pillar scheme affects organizations collecting EUR20bn revenue for Pillar one. For those with revenue of more than EUR 750, pillar two is applicable.

The paper recommended implementing GloBE rules. Hence, 15% minimum domestic tax for organizations under the in-scope GloBE circle. It extends ease to the operational companies.

If Jersey considers the implementation of GloBE, it may not happen before January 1, 2024. Lastly, the domestic corporate tax regime will not affect the businesses outside the GloBE circle.